| View previous topic :: View next topic |

| Author |

Message |

Tracy

Joined: 15 Sep 2006

Posts: 551

Location: Toronto

|

Posted: Nov 25, 2009 22:28 Post subject: Keeping invoices? Posted: Nov 25, 2009 22:28 Post subject: Keeping invoices? |

|

|

And now, for something completely **neutral** - I would like to poll FMF readers to find out whether they keep invoices of mineral purchases, even if all the data from the invoices are entered into one's catalogue. If yes, is this true of all invoices, even ones written on generic receipt paper without any special imprint to know very much about the seller? I'm interested to know what the most common practice is. Please provide input even if just to say "I hadn't thought about doing this before, but maybe I will start" (or something like that). No penalties for either "yes" or "no" answers, this is just my own survey.

Thanks!

- Tracy

ps I have a new camera! I am getting the hang of how to use it and hope to post some new and improved photos to my collection thread soon. :)

_________________

"Wisdom begins in wonder" - Socrates |

|

| Back to top |

|

|

GneissWare

Joined: 07 Mar 2008

Posts: 1287

Location: California

|

Posted: Nov 25, 2009 22:38 Post subject: Re: Keeping invoices? Posted: Nov 25, 2009 22:38 Post subject: Re: Keeping invoices? |

|

|

Hi Tracy,

I keep all my invoices.

I've run across many old collections that have original receipts, and find the history to be fascinating. This is probably a debate that will draw along the same lines as an earlier thread about keeping old labels ( https://www.mineral-forum.com/message-board/viewtopic.php?t=347 ). Invoice add to the provenance, and allow the path of a specimen to be traced through its various owners and dealers, and provides some interesting glimpses into how prices have changed over time.

Bob

PS Hope you have a Happy Thankgiving!

|

|

| Back to top |

|

|

Peter Megaw

Site Admin

Joined: 13 Jan 2007

Posts: 975

Location: Tucson, Arizona

|

Posted: Nov 25, 2009 23:27 Post subject: Re: Keeping invoices? Posted: Nov 25, 2009 23:27 Post subject: Re: Keeping invoices? |

|

|

All epherma related to a specimen can be interesting, and I suppose we will one day have invoice collections to back up a specimen's provencance/pedigree...with collateral discussions of what this documentation adds to the specimen's value. However, I think invoices perhaps give us a broader view of the collector's history than the specimen's. I bought a huge reference collection a few years ago and it had virtually every receipt the guy ever received. It was fun to see what he'd paid for things, but most intersting to see was who he got things from consistently and who were one-off dealers..he was clearly sharp enough to trace sources upstream to the "original" and cheaper sources. Since most of the invoices were for multiple specimen purchases and therefore impossible to keep with all but one individual subject specimen, I decided that they should mostly go to someone who knew the collector and was interested in collecting history and philosophy rather than try to keep them with the individual rocks. They were gratefully received and foled. A small batch of the rest I used to embarrass one of his major sources, who gouged him for years!

_________________

Siempre Adelante! |

|

| Back to top |

|

|

bugrock

Joined: 24 Nov 2008

Posts: 137

Location: Michigan

|

Posted: Nov 26, 2009 00:13 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 00:13 Post subject: Re: Keeping invoices? |

|

|

Must admit I am guilty of not keeping a catalog of my collection but I'm told

by one mineralogist I know that this is common of many private collections.

On the other hand I try to add as much information as possible on the back of

specimen labels, the primary (last) label supplied by the dealer or to the

preprinted specimen label I fill in on my own. This includes the source

of the specimen, the collector if known, when the piece was acquired, and

the price paid if purchased.

When specimens are purchased from an internet dealer it is now easy to copy/

paste the specimen description into a word processing document, modify the

text to reflect what you wish to document, set the font type and size and produce

a small cut-out label that can be pasted to the back of the primary label. Someday

it may be useful to know what was paid for each piece.

Loose labels are dangerous of course, they can become separated from the specimen

or labels can be switched. But it seems easier for a file of invoices to be separated

from the specimens and it may not be possible to quite figure out which invoice entry

goes with which rock. If a catalog is kept however one could write the catalog number

after each item on the invoice.

Have a great Thanksgiving

|

|

| Back to top |

|

|

GneissWare

Joined: 07 Mar 2008

Posts: 1287

Location: California

|

Posted: Nov 26, 2009 00:55 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 00:55 Post subject: Re: Keeping invoices? |

|

|

| Invoices are ephemera, helping chart the history of specimens and the overall collection. Cataloging is wholly separate issue, and an essential part of our obligation as stewards of the minerals in our possession.

|

|

| Back to top |

|

|

Matt_Zukowski

Site Admin

Joined: 10 Apr 2009

Posts: 737

Location: Alaska

|

Posted: Nov 26, 2009 01:37 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 01:37 Post subject: Re: Keeping invoices? |

|

|

| I have not been absolute about this in the past but will in the future. I will scan a pdf of the receipt, old labels, etc and then keep the pdf with pictures, relevant other digital info, etc on my computer. The history is interesting as already pointed out, but keeping original documentation of cost basis may some day be important to defend myself against the IRS.

|

|

| Back to top |

|

|

Carles Millan

Site Admin

Joined: 05 May 2007

Posts: 1538

Location: Catalonia

|

Posted: Nov 26, 2009 06:45 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 06:45 Post subject: Re: Keeping invoices? |

|

|

| Tracy wrote: | | I would like to poll FMF readers to find out whether they keep invoices |

During the last 9 years or so I've been keeping the invoices I get from the dealers in a separate 'paper' archive. But when you buy minerals at a fair, the dealer does not usually deliver an invoice, unless you explicitly ask for it. And not always are you going to be successful, especially when dealing with 3rd world sellers. However, just for simplicity, I never ask for an invoice when purchasing at mineral shows, which might be a mistake if airport customs asked me to show it.

In addition to keeping a record of the specimen history, the invoices can also be useful to make it clear, if ever needed, that you paid for it and so such specimen was not stolen.

| Tracy wrote: | | ps I have a new camera! I am getting the hang of how to use it and hope to post some new and improved photos to my collection thread soon. :) |

Tracy, please, take other shots of your specimens with the new camera and post the photos for all of us to see them again.

_________________

Al carrer Duran i Bas, si no hi vas no t'hi duran |

|

| Back to top |

|

|

James Catmur

Site Admin

Joined: 14 Sep 2006

Posts: 1482

Location: Cambridge

|

Posted: Nov 26, 2009 09:38 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 09:38 Post subject: Re: Keeping invoices? |

|

|

Tracy

I do keep them when I get them , but they are the one part of my filing that is weak if not very bad. So they are in a large file and it would take some hard work to get them to align with the collection. But I do keep the costs in my database so it would not be impossible

That said at shows I often do not get an invoice and some dealers are not always keen. Mines never give invoices!

James

|

|

| Back to top |

|

|

Carles Millan

Site Admin

Joined: 05 May 2007

Posts: 1538

Location: Catalonia

|

Posted: Nov 26, 2009 09:49 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 09:49 Post subject: Re: Keeping invoices? |

|

|

| James wrote: | | Mines never give invoices! |

But mines never charge you for field collecting (with a few exceptions, like some very known Spanish pyrite deposits).

_________________

Al carrer Duran i Bas, si no hi vas no t'hi duran |

|

| Back to top |

|

|

Joan Massagué

Joined: 24 Apr 2007

Posts: 40

Location: New York

|

Posted: Nov 26, 2009 09:51 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 09:51 Post subject: Re: Keeping invoices? |

|

|

Tracy,

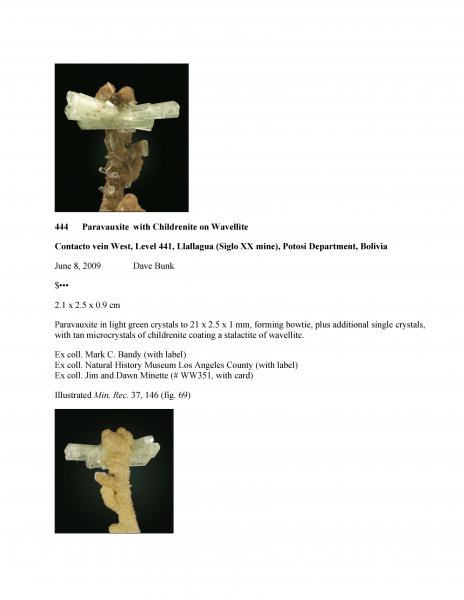

Regarding this and other related issues about collection record keeping discussed elsewhere in the FMF, here is a description of my system. I keep all invoices, no matter how trivial the document may be. Each invoice is kept with the specimen record sheet, which is a hard copy of the specimen file in my computer. In the event that multiple specimens are listed on the same invoice, I keep a photocopy of the invoice with every specimen record sheet. The specimen record sheet contains all the “vital” information about the specimen (see image below). The record sheet, the invoice, and all other relevant documents (specimen old labels, specimen correspondence and email printouts, if any) are kept inside a regular plastic protector sheet, and this inside a ring binder. A thick ring binder (2.5 in/7.5 cm) can hold about 100 of these, and so the records of my entire collection of nearly 500 specimens are archived in 5 binders. Electronic files and electronic pictures of every specimen are safely backed-up. The specimen number is glued on the specimen, of course. I have been using this system for many years and never found a need to modify it. Works for me!

| Description: |

|

| Viewed: |

23780 Time(s) |

|

|

|

| Back to top |

|

|

chris

Site Admin

Joined: 12 Jul 2007

Posts: 538

Location: Grenoble

|

Posted: Nov 26, 2009 11:45 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 11:45 Post subject: Re: Keeping invoices? |

|

|

Hi Tracy,

I keep every invoice of a purchase (even if it was written on a napkin) as I do for the labels of previous owners.

Christophe

|

|

| Back to top |

|

|

Jesse Fisher

Joined: 18 Mar 2009

Posts: 639

Location: San Francisco

|

Posted: Nov 26, 2009 20:23 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 20:23 Post subject: Re: Keeping invoices? |

|

|

| The invoice is proof of what you have paid for the items in your collection. In the event that you sell your collection, you are likely to owe income tax on the profits of the sale. Without the invoices, you have no proof of what the items in the collection cost you and could be held liable for Capital Gains tax on the entire sale. Now, if the collection is not of any great value this is not likely to be an issue, but if the collection does eventually end up being worth something, having those receipts could make life easier when dealing with the tax man.

|

|

| Back to top |

|

|

bugrock

Joined: 24 Nov 2008

Posts: 137

Location: Michigan

|

Posted: Nov 26, 2009 23:11 Post subject: Re: Keeping invoices? Posted: Nov 26, 2009 23:11 Post subject: Re: Keeping invoices? |

|

|

Jesse brings up a point that seems quite important but does anyone know of examples where the IRS has called a sale into question due to lack of documentation of purchase price?

Is there a sale value that in particular triggers the IRS to call a transaction into question?

Would think that the situation is quite different for a private collector vs someone who is a dealer with a business tax ID (even if that ID is acquired only to gain early access to shows etc).

In the case of very old collections, such as one that has been in the family for years, it might be quite difficult to provide detailed documentation.

Are there any accountants on this forum that can provide advice?

|

|

| Back to top |

|

|

GneissWare

Joined: 07 Mar 2008

Posts: 1287

Location: California

|

Posted: Nov 27, 2009 01:59 Post subject: Re: Keeping invoices? Posted: Nov 27, 2009 01:59 Post subject: Re: Keeping invoices? |

|

|

Your posts raises a bunch of issues. These answers are generally right, though there are lots of complexities in the tax code, and each case needs to be evaluated individually. Of course, this response only applies to the USA.

| bugrock wrote: |

Is there a sale value that in particular triggers the IRS to call a transaction into question?

|

Based on IRS code, any personal sale of a tangible asset on which a gain is realized is taxable as a capital gain, and is supposed to be reported. I guess if there is no paper trail then the IRS wouldn't know it occured, and might not catch you if you didn't report the capital gain income. It doesn't mean that you aren't required to report the income, however. The larger the sale price, the greater the chance it may be discovered at some point.

| bugrock wrote: | | Would think that the situation is quite different for a private collector vs someone who is a dealer with a business tax ID (even if that ID is acquired only to gain early access to shows etc). |

The main difference between a private sale is that a "profit" is reported as a capital gain, whereas a dealer's profit is reported as straight income.

| bugrock wrote: | | In the case of very old collections, such as one that has been in the family for years, it might be quite difficult to provide detailed documentation. |

For collections that are inherited, there is a step up in value, meaning that the person inheriting the collection's basis (or "cost") would be the value on the date of the death of the person willing it to you. In this case, if the collection was originally assembled at a cost of $5000 over its life, and was worth $100,000 on the day the owner died and you inherited it, then your basis would be the $100,000. If you sold it for $120,000 then your capital gains would be $20,000. This is why people appraise collections upon the settlement of an estate, if they intend to keep it, so they can establish the basis and minimize the gain if they later sell it. If you sell the collection shortly after estate settlement, then the basis for the collection will be considered the same as the sale price, and no gain will be realized for the heirs.

Hope this helps.

|

|

| Back to top |

|

|

James Catmur

Site Admin

Joined: 14 Sep 2006

Posts: 1482

Location: Cambridge

|

Posted: Nov 27, 2009 16:39 Post subject: Re: Keeping invoices? Posted: Nov 27, 2009 16:39 Post subject: Re: Keeping invoices? |

|

|

Should the worry about the tax man make us all less keen to tell others what we paid? As has been said by others "the internet never forgets". So maybe in the future the tax man will track down a copy of a web page somewhere and find out what we paid years ago.

I think that keeping records does make sense and I ought to get mine into a better state than just a note on my database (which does tell me what I paid in which currency and in £ at the exchange rate on the day I bought the specimen). So I do have that data, but no proof.

James

|

|

| Back to top |

|

|

|